Freshers on a Budget: How to Save Money in your first year at University

Charlie Stirzaker·Aug 3, 2022

Charlie Stirzaker·Aug 3, 2022

Heading off to uni this year? We’ve got all the tips & tricks you need to survive your first year as a fresher without blowing your budget.

About the author: Hi, i’m Charlie and I work part time for NetVoucherCodes as a content writer while I study at University. I’ve just finished my first year and want to share some top student saving tips which helped me save during my first year at university

You’ve passed your exams, your bags are packed and you’re ready to head into your first year of uni life, congratulations! And while there will be flat parties, nights out and hangovers in abundance, there’s also the small task of navigating your way through adult life.

Banking, Budgeting, the list goes on. For many of you, this will be your first taste of life away from home and it can be somewhat overwhelming. That’s why we’ve rounded up all the tips & tricks you need to kick start uni life with a bang and most importantly, on a budget!

What’s in This Guide?

- Freshers Week

- Food Shopping

- Budgeting

- Travel

- Banking

- Cheat Meals

- Hangover Cures

- Shopping Online

- Making Extra Cash

- Watching TV

- Insurance

- Keeping Fit

- Moving in Essentials

Freshers Week

There’s no denying that your uni days are those you will look back on and be talking about for decades, so you’re going to want to make them count! Freshers week (or month) is the term dubbed for those first few messy weeks of settling in, meeting new people and getting drunk.

From flat parties to sleepless nights, socials, and all the antics in between, living the high life can be no mean feat! So to avoid dipping into the overdraft after week one, check out our going-out tips to reign in your expenses without having to say no to a night out.

Make the most of Freebies

Whether you’re at a city uni or campus, you’ll notice reps here there and everywhere handing you free vouchers. And remember, you’re a student now, you need all the freebies you can get.

Be sure to grab as many as you can, these may just be your lifeline during freshers’ week. From free food to free shots, free entry to the clubs, free travel and even free mobile offers, keep your eyes peeled for student or uni reps near you and never turn your nose up at a freebie.

Don’t forget to make your way to the fresher’s fairs too! This is the perfect place to grab some free goods and essentials that will make your first week a little easier and can help you learn a little more about your uni, societies, sports clubs and what’s available to you.

Drink before you leave

If you’re keeping costs low during the fresher’s period, flat parties are the perfect way to mingle with your new roommates while sticking to a budget. Club together for some cheap drinks and play some party games before heading to the clubs. The more you drink before leaving, the less you will need to spend topping up.

Social Nights

You’ll notice during freshers week that the prices of drinks in the clubs and bars tend to be cheaper than normal for students! Eventually, they will creep back up, but it’s always worth noting which clubs or bars offer social nights. These will typically be on a weeknight where you can buy double spirits for half price or less.

Happy Hours are your Best Friend

Who doesn’t love a happy hour? And during freshers week and your first year of uni, they’re a great way to double up on your drinks without paying full whack. If you’re planning a big night out, it might be worth heading down to your local pub or bar offering happy hour to booze up before venturing to the clubs.

Food Shopping

Like millions of other students just like you, University is your first real taste of venturing into the world alone – and that means doing the food shopping.

And if you’re wanting to keep well fed during your first year at uni, you’re going to want to get savvy with your shopping skills! Luckily, we’ve got all the tricks to stop you from eating through your student loan.

Choose Cheaper Stores

We all know by now that some supermarkets are much more expensive than others! And if you’re a student living on a tight budget, shopping at the cheapest possible places is essential. Always choose stores like Aldi or Lidl for your food shop and Poundland, Home Bargains or B&M for other store cupboard staples and cleaning supplies.

If none of those stores are local to you, it might be worth signing up for a store card at whichever supermarket you can access. This way, you’ll earn points with each purchase to use on future buys.

Club cards are great if you’re a Tesco shopper, but don’t always believe you’re getting the best deals! Even with exclusive discounts, prices still may be lower in the likes of Aldi or Lidl.

Shop at the right time

Following on nicely, shopping at the right time is a great tip for bagging some serious bargains in your local supermarket or store. Yellow stickers will usually show up early in the morning or later on in the evening and are fantastic for grabbing meats, fruit, veg and other perishable goods at bargain prices.

Of course, you will need to consider Used by and Best Before dates to ensure you will make use, but if not, stick them in the freezer for another time!

Stock up on Store Cupboard & Freezer Foods

Storecupboard foods are much cheaper than buying fresh goods, and as much as we love a fillet steak, you’re going to need to get creative with your meal plan! Pasta, noodles, cereals and tinned sauces & veg are quick, tasty and most importantly, cheap to stock up on and are easy to reach for as and when you need them.

If you happen to spot some good multi-buy offers on essentials like toilet rolls or tinned food, make sure to stock up. Toilet paper can be gold dust towards the end of term, so it’s always worth having a few under your bed when you need them most.

Freezer foods are also cheap to buy and can last, well, forever! Buy frozen meats as they are much cheaper and last a lot longer or stock up on frozen meals as a cheap alternative when you don’t fancy cooking. We have a handy guide on foods you can freeze that’s worth checking out as it can save you a fortune in wasted food.

Downshift Brands

If you’re on a tight student budget, downshifting brands is a sure-fire way to save some pennies on your next food shop!

Always go for supermarket own or cheaper brands of foods, and if you can’t tell any difference, stick with the cheaper brands. So, if you usually pick up a 4-pack of Heinz Beans, drop down to a cheaper brand or a supermarket’s own brand.

Student Discounts

Some stores, like the Co-op, offer student discounts including 10% off items in-store with your TOTUM card. This is worth noting if the Co-op is close to your uni accommodation as it may very well be a staple store for you.

Chip in for essentials

Living in uni accommodation? Make things cheaper for everyone by chipping together to buy essentials like toiletries and cleaning supplies.

Check out our How to Save on your Food Shop and meal planning on a budget blog posts for the full low-down on how to cut the costs of your food bill.

Budgeting

Uni is one of the most exciting times of your life, but it also comes with a lot of new responsibilities that can feel overwhelming. One of the most important responsibilities you have as a student is managing your money and if you’re not prepared, you will end up overspending and leaving yourself skint months before your next loan.

Avoid overspending by budgeting your money. There are loads of easy budgeting techniques you can follow to make sure you always have the cash to fall back on. Here are some of our favourites:

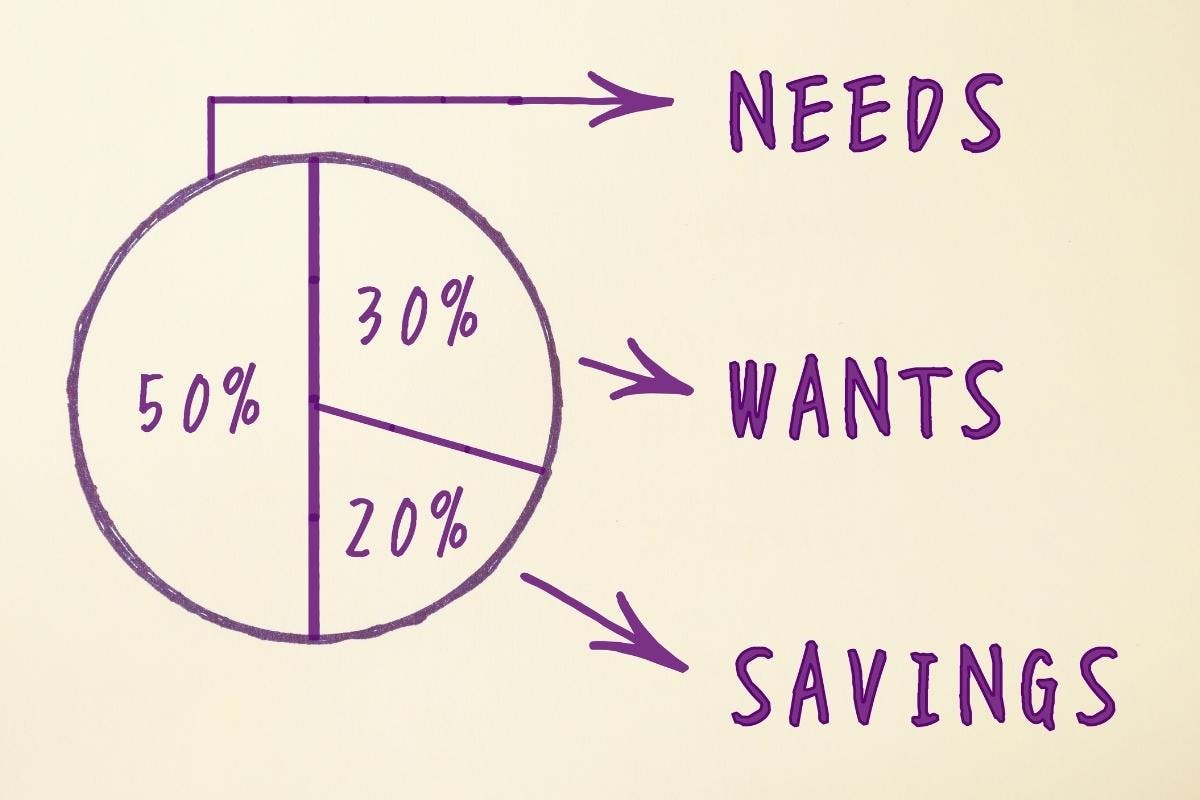

50, 30, 20 Rule

This rule is simple, once you receive your loan split it into three categories using the percentages 50, 30 and 20. Use 50% for your needs such as food, accommodation and travel, 30% for your wants like nights out and TV subscriptions and 20% for your savings or to pay off debt.

This rule is not only realistic, it still allows you to enjoy yourself without draining your bank account. Give it a try and see how much easier managing your funds becomes.

Track Your Spends

Another great way to stay in control of your expenses is to make a list of all your outgoings. Calculate how much you will be spending each month, deduct it from your student loan and make a note of each expense in the notes app on your phone.

This way, you can track how much you’re spending and you’ll know how much you have left over for a night out and non-essentials.

Once you have this figure in mind, you can keep an eye on your transactions to make sure you don’t exceed your limit. By doing this, you should have a steady balance between your ingoings and outgoings and can avoid getting into debt for things you don’t need.

Create Mini Budgets

Before going out, create yourself a mini-budget for the night. By limiting yourself to a certain amount you can make sure you don’t drastically overspend and ruin the next few weeks by being skint.

Of course, once the drinks are flowing, sticking to your word can be easier said than done, so why not withdraw the amount you want to spend as cash and only use that? Once your wad of cash runs out, you’ll know it’s time to call it a night.

Travel

Travel is a big part of your day-to-day life as a student. Not only will you be travelling to and from uni each day, you will also need regular lifts into the city centre for nights out, not to mention the regular journeys back home during the holidays. During the year, travel expenses can really add up but there are a few ways to keep costs low.

Get a Railcard

If you’re going to be taking regular train journeys from home to uni then it’s well worth getting a 16-25 railcard. With a student railcard, you’ll save ⅓ off rail travel for the whole year, saving you an average of £159. Pay just £30 for 1 year or keep yourself covered during your whole time at uni by paying just £70 for 3 years.

Split Ticketing

Another great tip for those of you travelling by train regularly is split ticketing. This technique is completely legitimate and can save you up to 90% on your train fares. All you have to do is buy multiple tickets rather than a single to bring down the total cost of your fare! Look out for the Split Save icon when browsing for tickets on the Trainline app and see how much you could save.

Get a Bus Pass

If uni is a good walk away from your accommodation then you may want to consider getting a bus pass. Bus companies like Stage Coach provide bus passes for students as well as local companies in cities and towns across the UK. Before starting uni, research which bus you will need to get to uni and sort yourself a bus pass- it’ll save you money in the long run!

Uber vs Taxis

In cities like Manchester, Uber is a really affordable way to travel around. However, before you book your Uber, make sure you wait until the prices are at their lowest. If prices are surging you could end up paying almost double the standard price so it’s better to wait or opt for a taxi.

Another thing to consider is local taxi prices. In cities like Liverpool, Delta and Alpha taxis are much cheaper than Ubers, so a quick call to the local taxi firm is the more affordable option. However, this isn’t the case in all locations, the key is to do some research before you head out to see which is cheaper.

Oyster Card Hack

If you’re heading to London for uni then an Oyster Card is a great investment. Public transport is the easiest way to get around the city and with an Oyster Card, you will save yourself a lot of money.

Buy an 18+ Student Oyster Card for just £25 and save 30% on TravelCards and bus and tram passes. You can also attach your 16-25 railcard to your Oyster Card to save 34% off pay-as-you-go off-peak fares and daily caps for the tube, London Overground, Elizabeth Line and most National Rail services in London!

Banking

Banking and organising your finances will be a crucial part when becoming a student, especially if you’re living on-campus or in student accommodation. Juggling your rent with food shopping, bills and the rising cost of living can feel like you’re stretching your student loan to the max.

It can be easy to go over budget and slip into bad habits like dipping into your student overdraft or taking out loans, and these can be deep waters to get out of.

To avoid getting on the wrong side of your finances, check out our handy tips for ways to organise your finances, budget your money and live within your means!

Get Organised

A great hack for keeping on top of your finances is to know how much you owe each month. Create a simple list on your phone with how much money you receive in loans or from work and write down exactly how much you owe out each month on rent, bills and other expenses like fuel, phone bills or Netflix.

Transfer anything left over to another account so you know exactly how much you have left to spend on nights out and new clothes.

From there, split your leftover money into spending allowances. Allocate X amount for food, drinking and so on. This way you’re much less likely to overspend.

Best Budgeting Banks

Monzo, Chase and Starling banks are fantastic for tracking exactly what you spend your money on. They categorise your spending into groups like groceries, eating out, drinking and fashion! Best of all, with a few simple checks, they’re completely free to open and accepted everywhere across the UK, Europe and around the world.

These will allow you to keep a track of where you’re spending the most money and prompt you to reign it in a little in unnecessary areas, or not.

Get to know your bank

If you’ve opened a student account with your local bank, it’s a good idea to clue yourself up on what you’re entitled to and what it can mean for your financing.

Like all student bank accounts, you will be given a 0% interest-free overdraft up to a maximum of £3000. These can be a lifeline for students when they need that extra help, but it’s important you know the repayment conditions!

Remember, overdrafts aren’t ‘free money’, sooner or later they will need to be repaid and a sudden bill for £3000 is certainly not what you need on a rainy day.

If you’re regularly using your overdraft, try to make regular payments to pay back what you owe to save yourself a large bill in years to come.

It’s useful to know that some banks also offer an incentive for signing up for their student account. HSBC, Santander, NatWest and RBS offer incentives like £100 cash in your bank, a 4-year railcard or a 4-year tastecard with £80 cash.

Cheat Meals

During your time at uni, cooking will become a big part of your day-to-day life. But on those days where you can’t be bothered or fancy a treat, make sure you’re as savvy as possible about the food you buy.

It’s easy to overspend on cheat meals and takeaways but with a bit of planning, you’ll find a wealth of resources that can help you save on your next food order.

Coupons & Codes

If you’re craving a takeaway after a night out, make sure you look for a code before you buy. If you sign up for Uber Eats you’ll get regular discount codes sent to your email.

You should also keep an eye out for any coupons that get posted through your door. You’ll often find coupons for your local KFC and Dominos so make sure you save them for the days you fancy a treat!

Usually, takeaways like Dominos also include a card or voucher in their pizza boxes for money off your next order. Save these for a rainy day and enjoy a budget take away the next time you’re hungover.

McDonald’s Hacks

There are loads of money-saving hacks for McDonald’s including the unlimited £1.99 Big Mac & Fries offer. Instead of paying £4.08, get a Big Mac & fries for just £1.99 when you use any McDonald’s receipt to fill out the online customer satisfaction survey. Simply enter the code on your receipt within 60 days of receiving it and redeem your discount!

Or, you can always download the McDonald’s app for daily deals and freebies. On Mondays, Maccies offer cheap one-day-only deals for 99p burgers when you buy via the app, so make sure you download it so you don’t miss out. When you register for the app you will also save 20% off the entire menu on your first mobile order!

If you have a Student Beans account you can also get a free Cheeseburger, Mayo Chicken or McFlurry both in-store and online by showing your student ID.

Other hacks include making your own DIY burgers. Instead of paying £3.69 for a McChicken Sandwich, order a 99p Mayo Chicken. Or, order a Double Cheeseburger with extra toppings for just £1.59 instead of buying a £3.69 Big Mac.

If you’re after 12 chicken nuggets, you can buy two boxes of six for £7.58 however, it is worth noting that for £1.79 less, you can get 8 more McNuggets if you buy the Sharebox at £5.79.

Hangover Cures

As a freshers student, you will without a doubt be partial to a hangover or two! If you’re struck down with ‘Freshers Flu’ within the first week of uni, you’re not alone.

Not feeling yourself when you’re away from home can be daunting, but knowing what to do and where to go when you’re feeling fragile can be really useful.

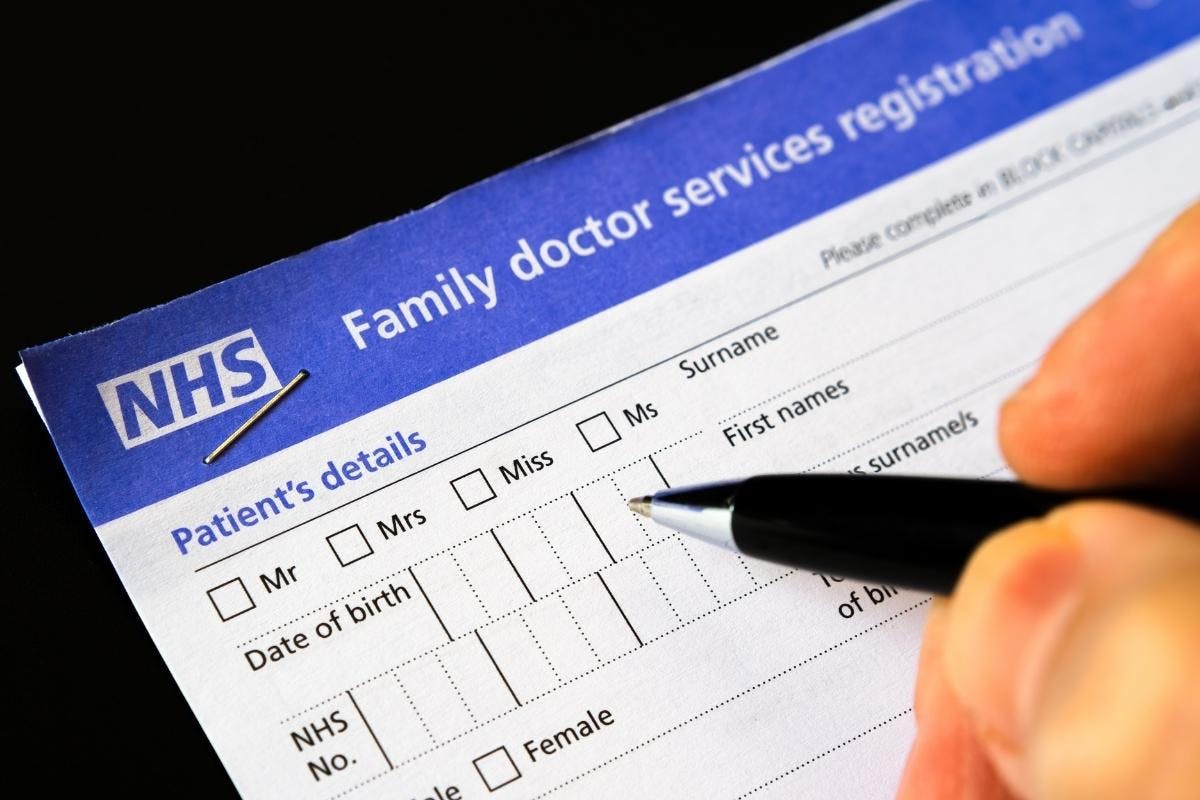

Register with a local GP

It might not be the first thing on your mind, but make sure after arriving at your university you register with a local GP. If you’re going to live in a new city or town for a long time, having a doctor you can visit when you need to is essential. This way, you can access health care services quickly and easily while away from home.

If you have an ongoing health condition or chronic illness, this is especially important!

University Health Centres

University health centres are a great port of call if you’re looking for health services or advice. You can also ask your local pharmacists free of charge for medical advice and support.

Shop Affordably

If the hangover has kicked in or you’ve been struck down with freshers’ flu, make sure you head to your local supermarket or bargain store before visiting the pharmacy. Avoid being stung by hefty prices and opt for the supermarket’s own branded medication!

Many branded and non-branded over-the-counter medications like paracetamol and dioralytes are exactly the same, however, you will pay much more for the branded goods. Make sure to pick up a Lucozade sport while you’re out or any other cheaper energy drink! These are great for rehydrating you after a heavy night.

Rest & Eat Healthily

It may sound simple, but you will greatly decrease your chances of getting poorly by looking after yourself. Being a student can be difficult, with temptation everywhere. Make sure you’re getting enough rest, eating a balanced diet and staying active!

Shopping Online

You may be worried that once you start uni you won’t be able to afford all the extra luxuries you did at home. But, if you budget your money sensibly and get smarter about how you shop, you will still be able to buy all the things you love.

Student Discount

One of the first things you need to do is sign-up for student discount apps like UNiDAYS and Student Beans. Simply enter your student details and uni email and gain access to hundreds of discounts for high-street stores.

With student discounts, not only will you be able to save money at online clothing stores like ASOS and Pretty Little Thing, but you’ll also be able to save when shopping in-store around your local town or city.

You’ll even be able to find student deals for tech brands like Apple, Samsung and Intel, allowing you to save on laptops and tablets for your uni work.

Online services like Amazon and Spotify also provide student discounts on subscriptions. Sign-up for Amazon Prime with your student discount and enjoy next-day delivery on textbooks and any other essentials you may need.

Newsletters & Apps

If you have your eye on a new outfit or pair of trainers, don’t rush to the checkout as soon as your loan comes in. The best thing to do is sign-up for retailer newsletters and wait for a decent code to appear.

Stores usually provide codes at the end of the month around payday. However, retailers like ASOS tend to release codes to app users around mid-morning on weekdays so it’s well worth downloading these apps if you want notifications for daily discounts.

When you sign up for a newsletter or create an account at an online store, you’re also likely to receive discount codes on your birthday and special occasions like Valentine’s Day and Black Friday.

When your parcel arrives, also remember to have a look for a card or leaflet inside. Stores like Look Fantastic and Cult Beauty often provide free samples or cards for a discount on your next purchase with each order.

Student Cards

If you’ve recently become a student, you will have most likely heard of student cards like Totum. The question is are they worth it?

While student discount apps like Student Beans and UNiDAYS are free, Totum requires a sign-up fee of £24.99 for 3 years. This works out at just £8.33 per year for 300+ student discounts and premium discounts for stores like Co-op and Boots.

With a Totum subscription, you’ll also be given a ISIC digital card for 12 months. These are international student ID cards that allow you to prove your student status worldwide, granting you access to 150,000 discounts and benefits. This is ideal for those of you that are planning to take a gap year or are able to study abroad during your degree.

Totum cards also give students access to exclusive giveaways, cashback offers, coupons and freebies as well as discounts for local/independent stores, making the small fee more than worth it.

If you are reluctant to spend the £24.99, you can always sign-up for the free digital card that will allow you to save at online stores only. With the digital card, you will have limited access to all of Totum’s benefits but you’ll still be able to use it to save money at over 300 online stores.

Making Extra Cash

Having a side hustle can go a long way when living off a student loan. No matter how small it is, those extra couple of pounds can be priceless when you’re looking for the money left on the side to treat yourself.

The idea of a side hustle is great, but you’re probably wondering how you can put it into practice. That’s why we’ve put together some easy and simple ways you can earn yourself a little extra cash to spend on the weekends.

Become a Delivery driver or rider

If you’re lucky enough to have your car with you at uni, get your money’s worth out of the expensive insurance by becoming a delivery driver for specialist companies such as Deliveroo and UberEats.

You don’t need a car to become a driver too, grab a pushbike and you can cycle people’s orders to them. This is a great way to stay fit whilst also earning yourself a little extra money on the side.

Online Paid Surveys

Not only is answering surveys and testing products a great way to earn yourself some quick cash, but thanks to the huge array of surveys available on popular sites such as BrandedSurveys, Swagbucks, Survey Junkie and Opinion Outpost to name a few, it couldn’t be any easier to complete.

Just complete the forms provided by some of these top survey sites and you could earn as much as $5 a survey. Remember, the more you do, the more you earn!

Review Websites and Apps

As a student, you’ll spend a lot of time researching and browsing the internet, so why not get paid for doing it in your spare time too. All you have to do is review a website or app listed on UserTesting and you’ll be paid via PayPal, granting you instant cash for your opinion on the website in return, it’s almost too good to be true!

Sell your Unwanted Goods

If you’re looking around wondering where you can save a little extra money, why not have a look through your wardrobe and drawers for old clothes, DVDs and gadgets to sell online. This can be very rewarding and a really easy way to make some money, as one student’s trash can be another person’s treasure!

If you’ve got textbooks from old modules, make sure you keep hold of them for when the next set of freshers join, that way you can sell them and earn some of the money you spent on purchasing them back.

Marketplaces such as Facebook, and GumTree are great for flogging your goods locally, while Depop & Vinted are ideal for selling further afield.

Get a Part-Time Job

If you don’t fancy a side hustle, there is always the option of picking up a part-time job with flexible hours to accommodate your studies. These jobs will build your skills and work experience. However, finding a well-paid job as a student can be difficult. To make sure you find all the best part-time jobs, make sure you check out job sites such as reed, indeed, total jobs and more.

Another great tip is to apply for a part time job at a restaurant or takeaway as it’s likely you’ll get some free leftovers or even complimentary meals!

Watching TV

Whether you are binge-watching Netflix or watching live sport in your accommodation with your mates, it’s important you do it for as cheap as possible without breaking the law. Make sure you’re clued up with the TV licence rules surrounding live TV, as well as all the student subscriptions and bundles you can take advantage of whilst lounging around in your room.

Split the cost of your TV Subscriptions

One of the simplest solutions to paying less on your Netflix, Amazon Prime and Disney+ subscriptions is by sharing the accounts with your roommates. This way you can spread the cost of the subscriptions between you, giving you more subscriptions for less.

A top tip to do this would be to create a shared email address, that way none of you will be locked out of the account when you forget the password after a long day on campus.

Save by Leapfrogging

Students can save money on TV subscriptions by ‘leapfrogging’. The process is simple, you plan which shows you want to watch during the month and subscribe to the streaming site it’s available on. The following month rotate your streaming services and ditch the ones you don’t need!

For more information about how you can save yourself money by using the leapfrogging method efficiently, head over to our Ways to Save Money on your TV Subscriptions blog to find out more.

Sky and NowTV

If you’re lucky enough to have parents already paying for Sky TV and they have a TV licence at home, you can stream Sky Go completely free on your laptop, smartphone or even your games console using their Sky TV account.

Sky also offers NowTV subscriptions, this is a great way to access Sky Sports starting from just £11.99. This way you can watch the match from home and you won’t be spending money on drinks in the pub watching the sports you love the most.

Do you need a TV Licence?

TV licences are a grey area at university, with many shrugging their shoulders and risking the dreaded fines coming through the letterbox. However, what a lot of students don’t know is that you can claim a refund on your TV licence as soon as you leave your accommodation at the end of the year, that way you’ll only pay ⅔ of the full price!

You can get away without paying a TV licence if you only watch on catch-up, making ITV Hub and All4 your best friend. Students do not need a tv licence to watch programmes which have already been aired on television, however, you will need one to watch BBC iPlayer.

Mobile Plans including Free Streaming

Switch your mobile phone provider and not only could you save money doing so, but you can also bag yourself a free trial on selected streaming services. Sky Mobile customers can stream Sky TV for free and EE offers customers free access to BT Sport, granting football fans access to Premier League and Champions League games whilst receiving unlimited data and minutes.

Free Trials

Before you splash out on a subscription to a new streaming service, check for a free trial and save yourself some money. Free trials don’t just allow you to try before you buy, they’re also a great way to watch your favourite films and TV shows for free. Always remember to cancel if you don’t plan to subscribe fully as payment will be taken from your account automatically.

Insurance

Making sure your valuables are insured when you’re at university is important as if you were to lose or damage your laptop or phone, then the cost to fix the issue can leave you well out of pocket.

To make sure you’re covered for as cheap as possible, we’ve found all the best phone and gadget insurance deals available to students to protect your work and phone.

Protect your Bubble

One of the best mobile and gadget insurance companies for students is Protect your Bubble. And thanks to their student discount, you can save a huge 15% on a wide selection of insurance covers.

Choose to insure up to 3 devices, and should any of your valuables be stolen, damaged or breakdown, you’ll be covered. And with cover under your belt for just a small fee, you won’t find yourself paying over the odds for repairs.

Contents Cover

If you’re a student living in halls or your own student home, you can also make sure you’re covered in the event any of your belongings are stolen or damaged through content insurance. To make sure you get the best deal on student content insurance, make sure you compare the market with top comparison sites such as Confused.com.

Keeping Fit

It’s important to make sure you have enough time to work out and stay on top of your fitness goals when you go to university, as everyone can be easily drawn into the unhealthy lifestyle that comes with being a student.

We know working out can be expensive, especially when you’re looking after what you eat, which is why we’ve found all the best ways you can save money whilst keeping fit and healthy at uni.

University Gyms

If your university has a gym, then the chances are you’ll have free access with your student card. Although these gym spaces can be crowded at times, it’s a great way to stay fit and save without spending money on a commercial membership.

Not all university gyms will be free to use, with universities across the country adopting their own approach. It’s important to evaluate the pros and cons of working out at the university gym as other gym memberships may be cheaper!

Cheap Protein Supplements

You don’t have to spend a fortune on proteins and post-workout supplements to make sure you get the correct protein intake after your gym session. You can find cheap protein products from the likes of Aldi and Home Bargains, with protein yoghurts, pudding pots and milkshakes all available for bargain prices, making them the perfect alternative to expensive protein powders.

Use a Student Discount on Gym Wear

Get kitted out for the gym for less when you make use of student discounts at the checkout pages. You’ll find all the latest student discounts on your favourite gym clothing sites at NetVoucherCodes, UNiDays and Student Beans.

Moving in Essentials

Packing up your life before heading off to uni can feel a little overwhelming. So to make it that extra bit easy, we’ve created a checklist of 10 essentials that will make the transition from home to university more comforting.

- Plates

- Cutlery & Utensils

- Mugs & Cups

- Pots & Pans

- Bedding

- Toilet Roll

- Towels

- Toiletries

- Cleaning Supplies

- Store Cupboard Essentials

Before you run out to the shops to stock up, why not have a look around your home to see what’s going spare? It’s even possible your parents or grandparents have old mugs or plates laying around in cupboards. See what you can gather before reaching for your wallet. And remember, try not to overpack! Two of each item is enough to survive your first year.

If you decide you want to buy all new, make sure you’re spending your money wisely! Home Bargains, B&M’s, Wilko & Aldi are super affordable and will often lower their prices on uni essentials around early September. Some stores even offer a University Starter Pack with all the necessities listed and more at really reasonable prices.

Our Top Tips for moving in are:

- Shop around

- Compare prices

- Buy early

- Split the costs

- Don’t overpack!

WarriorCode

30% off Everything at Warrior

CoverForYouCode

Exclusive 10% off Travel Insurance at CoverForYou

FootasylumCode

Up to 20% off selected orders at Footasylum

20 Side Hustles You Can Start Today to Earn Extra Money in 2025

Apr 7, 2025

Looking for ways to boost your income without quitting your day job? You’re not alone. With the cost of living continuing to rise, more people than ever are turning to side hustles to top up their income, save for something big, or simply make ends meet. The good news is that there are loads of […]

How to Enjoy Easter Without Overspending

Apr 7, 2025

Easter is the perfect time to relax, get outdoors and spend time with family – but it’s easy for the costs to creep up. From Easter eggs and crafts to days out and entertaining the kids, expenses can quickly add up if you’re not careful! That’s why we’ve put together this ultimate Easter savings guide […]

The Real Cost of Glastonbury 2025 and How to Save Money This Festival Season

Apr 1, 2025

At £1,037.99 for the full five-day experience – Glastonbury 2025 is the most expensive in it’s history. Festival season is fast approaching, and for the lucky ones who managed to bag Glastonbury tickets, the countdown is officially on! But once the excitement fades, there’s one unavoidable truth – going to Glastonbury in 2025 isn’t cheap. […]

65 Quick Wins to Help Beat Awful April

Apr 1, 2025

Practical ways to save money across food, energy, bills, subscriptions and more. It’s 1st April – and for millions of UK households, ‘Awful April’ has officially arrived. From today, a wave of price rises is hitting everything from energy bills to council tax. Water bills are going up by an average of £10 a month […]

How Retailers Use Discounts to Make You Spend More

Mar 31, 2025

Retailers often rely on price drops to make customers feel excited, using ‘fake discounts’ as powerful psychological tools to drive spending. Oftentimes, discounts are genuinely good, but sometimes they’re engineered to make you buy more, even when you don’t need the item. Not only do discounts release dopamine, making shopping feel rewarding, but they also […]

Which UK Loyalty Cards Offer the Best Deals?

Mar 31, 2025

From discounts and special offers to cashback and free products – Loyalty Schemes can make a real difference to your shopping bill. Loyalty cards and reward apps have been around for years, but recently, more brands than ever have jumped on board, offering exclusive perks for customers who sign up. In some cases – like […]

Mother’s Day Gifts That Look Expensive (But Aren’t!)

Mar 24, 2025

Spring is officially in the air, meaning Mother’s Day is just around the corner for those who celebrate! Falling this year on Sunday 30th March, we’re sharing ways you can make Mum feel loved and appreciated without spending a fortune. You’ve probably already spotted the shelves packed with gifts and goodies in preparation for the […]

Stupidly Obvious And Simple Ways To Save Money Every Day

Mar 13, 2025

Do you want to put money away into savings? Or do you have credit card debt that you’re working off? Either way, trying to save money can sometimes feel hopeless – especially when the cost of living is always on the rise. But that doesn’t mean it’s impossible – it just means that you need […]

How to Winter-Proof your Home on a Budget

Jan 16, 2025

As energy bills rise and temperatures drop, preparing your home for winter is essential, not just for comfort but also for saving money. The good news is that winter-proofing doesn’t have to be expensive. With a few simple adjustments and affordable investments, you can reduce heat loss, cut energy costs and stay cosy without straining […]

How to Save Money in January: 10 Small Changes for Bigger Savings All Year Long

Jan 9, 2025

The new year is the perfect time to reassess your spending habits and pinpoint small ways you can cut back. With just a few small changes to your lifestyle in January, you can make significant savings that will add up over the course of the year. From cutting down on unnecessary costs to shopping smarter, […]